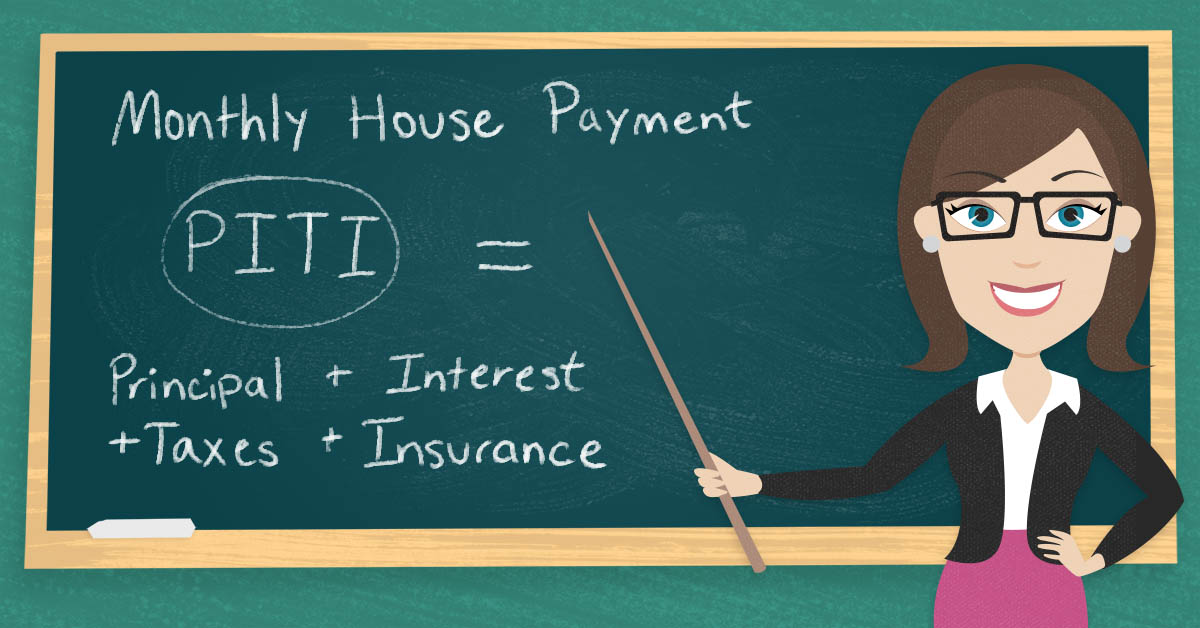

What does PITI mean?

When you think of your mortgage payment you may think of just the loan portion (principal and interest) or the loan portion plus your monthly amounts of property taxes and homeowners’ insurance. You may hear this information broken out fully or abbreviated to the term PITI which simply stands for Principal, Interest, Taxes, and Insurance. This week I wanted to talk about the 2nd half of that term, the property taxes and homeowners’ insurance.

Verify my mortgage eligibility (Feb 3rd, 2026)Property taxes are generally calculated at 1.25% of the purchase price to get the annual amount then divided by 12 to get the monthly obligation. For example: a home purchased for 600K would have an annual property tax bill of $7,500, which breaks down to $625/month. After you purchase the home, it takes the county about 6-8 months to catch up and update the tax records to the new amount, which can cause some confusion for the first year if you choose to have your taxes put in an escrow account that accompanies your loan. This lag by the county triggers what is called a supplemental tax bill and is something I will address later in this article. The important thing to note here is to understand how to easily calculate the monthly property tax obligation based on the purchase price of the home you are looking at. Simply take the price and multiply it by 1.25% then divide it by 12 to get that monthly amount.

The insurance portion of your housing obligation is a little more complex as it will depend on the company you choose and the level of coverage you select. You will select your own insurance company and coverage details. The only factor the lender will require you to choose is enough coverage to replace the home should it say burn down or need to be rebuilt for some reason. This is why a lot of people refer to this insurance as fire coverage but it’s basically the insurance to cover your home for any major damage that may occur. The bank needs to know that the home they have leant on can be fully put back to livable shape with the coverage you have. Beyond that you have the option of how much coverage you get for your belongings, how high or low of a deductible to choose etc. So, it’s best to shop around with a few carriers to see what coverage will cost in the price range you are shopping in. Usually, you start with whomever covers your existing home or your cars as you get a discount for bundling multiple policies. I would say that the big names AAA, State Farm, Farmers and Allstate all have good coverage but are on the more expensive side. I would also suggest choosing a higher deductible to keep premium costs down as you won’t be using your insurance for small claims as it tends to increase your premiums when you use it. There are also insurance brokers out there that can shop around for you and most of the time can be a cheaper option. It’s always best to do your own research but a good rule of thumb is $100/month up to about 500K and $150/month to about 750K and $200/month beyond that.

Staying with the 600K purchase price example, that would mean $750 for taxes and $150/month for insurance will be added to your loan payment (principal and interest on your loan) to make up your total monthly housing obligation. If you choose to have an escrow/impound account, your monthly payment will have an escrow account portion of it totaling $900 ($750 + $150). Each month this amount from your payment would be deposited into your escrow account and accrue throughout the year so that when your property tax and homeowners’ insurance bills come due, the mortgage servicer has the funds to pay these bills. Keep in mind that the money in your escrow account is always your money, the mortgage company is just managing it for you. Think of it like a savings account the mortgage servicer is managing. The money is always yours and accruing to be applied to the bills as they come due. If you pay off your loan due to a sale of the home or a refinance, whatever funds are in that account at that time that haven’t been used to pay your taxes and insurance bills, will be refunded to you in full. The lenders aren’t commingling the funds or taking your money, they just manage it for you so that they can be sure the bills are paid on time.

Verify my mortgage eligibility (Feb 3rd, 2026)The alternative to having an escrow account is paying these bills throughout the year on your own. If you put more than 10% down on a conventional loan, you have the option of waiving the escrow account and handling this task on your own. It’s important to note that FHA and VA loans will always require you to have an escrow account. Handling your own escrow account means that as the bills for your property taxes and insurance come due you have saved the correct amount of funds to pay them. Some people don’t like the pressure of managing this, but it can be as simple as opening a savings account and putting that $900 a month into that account so you will have the money accrued to pay these bills. The property tax bills come twice a year (November and February) and the insurance is renewed annually around the same month you close on your home. So, it all depends on your ability and willingness to manage the money or your preference to have the bank manage it for you. If you are decent at managing money and have the option, do it yourself. If you don’t trust yourself to put the money away, let the bank handle it so you don’t fall behind on these important bills. It can lead to foreclosure if you get seriously behind on taxes and forced insurance coverage if you fail to keep your own coverage intact. If you have questions about this, let’s chat and I am happy to dive deeper into why and how to go about this.

click here to use my mortgage calculator

Lastly, I want to address the supplemental tax bill phenomenon that every new homeowner will encounter and can cause a lot of confusion. I am going to link an article at the end of this that does a good job of breaking it down, but I want to touch on it briefly as well. When you buy a home, the tax base of the previous owner is 99.9% of the time lower than your new tax base after you close based on the price you paid. As I said earlier, it takes the county about 6-8 months to catch up with the sale transaction, so up until that time, the county has been taxing you at the previous owner’s (lower) tax base. Once the county catches up with the sale and updates the tax base to your new (higher) tax base that is based on your sales price, they realize that that have been taxing you at a lower rate from the sale date to the date they note the new sales price and the adjust the annual tax bill amount. To correct this, they send out a one time “supplemental tax bill” that makes up the difference between what they have been charging you and the amount they should have been charging you during that period. The amount of this one-time supplemental bill can vary widely and depends on how low the pervious owners tax base was compared to your new tax base. For example, if the previous owners tax base was $3000/year and your tax base is $7500/year, and it took the county 6 months to update the tax rolls from your purchase. That would mean that for half the year you were being taxed $1500 when you should have been charged $3750, so the supplemental bill to make up that difference would be $2250.

The biggest confusion comes when buyers have an escrow account and assume the mortgage service will pay this supplemental tax bill. Some do and some don’t. It all depends on the amount of the bill and the timing. If it takes the county too long to update the tax base, sometimes the mortgage servicer issues an escrow refund check because they have too much money in the escrow account and by law have to refund the borrower beyond a certain amount. Then the supplemental bill goes out and there isn’t enough money in the account to cover it and still stay on track to pay the regular annual taxes that are going to come up in November and February. So, it can be a mess that first year or so and this article would turn into a novel if I tried to address every possible scenario. But this is why I suggest, if you are allowed to and willing to manage your own escrow funds, do it. It will cause a lot less confusion and stress the first couple of years. I hope this is helpful. I you have more detailed questions, feel free to reach out to me directly and this is also something we would discuss when you find a home and we start processing your file. So, you don’t need to commit all this to memory but it’s good information to have. Check out the article below for more information on supplemental taxes as well.

Show me today's rate (Feb 3rd, 2026)